This post is written based on the following guide.

Table of Contents

Introduction

In the world of business, securing the right type of funding is a critical factor for success. The choice between equity financing, debt financing, and grants can significantly impact a company’s growth trajectory, control, and financial stability. Each funding option comes with its own set of implications, which must be thoroughly understood to make an informed decision. Moreover, understanding how to calculate and present Return on Investment (ROI) is vital for attracting investors and securing loans. This analysis delves into the specifics of various funding options, their implications, and how ROI can be utilized effectively.

1. Equity Financing

Equity financing involves raising capital by selling shares in the company. This method is commonly used by startups and high-growth companies that might not have the cash flow necessary to support debt financing. The key forms of equity financing include Venture Capital (VC), Angel Investors, and Crowdfunding.

1.1 Venture Capital (VC)

Venture Capital is a form of private equity financing provided by firms or funds to startups and early-stage companies that have high growth potential. Venture capitalists typically invest in exchange for equity and often play an active role in the company’s operations.

- Example: A well-known example is Sequoia Capital’s investment in WhatsApp, where Sequoia invested $60 million and earned substantial returns when Facebook acquired WhatsApp for $19 billion.

- Key Terms:

- Series A, B, C Funding: These are rounds of funding that represent different stages of a company’s growth. Series A focuses on scaling products, Series B on expanding market reach, and Series C on preparing for an IPO or acquisition.

- Exit Strategy: A strategy through which investors realize their returns, typically via Initial Public Offering (IPO) or acquisition.

Advantages:

- No Repayment Obligation: Unlike loans, equity does not need to be repaid, allowing the company to reinvest profits into growth.

- Strategic Support: VCs often provide strategic guidance, networking opportunities, and industry expertise.

Disadvantages:

- Dilution of Ownership: Founders may have to give up a significant share of ownership, potentially losing control over the company.

- Pressure for High Returns: VCs typically expect substantial returns on their investments, which can lead to pressure for rapid growth.

Key Aspects of Venture Capital Financing

| Aspect | Description |

|---|---|

| Investment Size | Typically ranges from $1 million to $100+ million depending on the stage of the company. |

| Investor Involvement | High; VCs often take board seats and play a significant role in decision-making. |

| Typical Sectors | Technology, healthcare, biotechnology, and other high-growth sectors. |

| Return Expectations | VCs generally seek returns of 10x or more within 5-7 years. |

| Control | High; significant influence over company direction and decisions. |

1.2 Angel Investors

Angel Investors are affluent individuals who provide capital to startups, usually in exchange for convertible debt or ownership equity. Unlike VCs, angel investors typically invest their own money and may be more involved in mentoring the business.

- Example: Jeff Bezos’s early investment in Google, where he invested $250,000 in 1998, which turned into a multi-billion dollar return after Google went public.

Advantages:

- Flexible Terms: Angel investors may offer more flexible investment terms compared to institutional VCs, especially in the early stages of a business.

- Mentorship and Guidance: Many angel investors are experienced entrepreneurs who can provide valuable advice and mentorship.

Disadvantages:

- Limited Capital: Angel investors typically invest smaller amounts than VCs.

- Potential for Personal Conflicts: The close relationship with angel investors can lead to conflicts if the business does not perform as expected.

Angel Investors vs. Venture Capitalists

| Factor | Angel Investors | Venture Capitalists |

|---|---|---|

| Typical Investment Size | $10,000 to $1 million | $1 million to $100+ million |

| Source of Funds | Personal wealth | Institutional capital |

| Level of Involvement | Moderate; often provides mentorship | High; often involved in strategic decision-making |

| Expected Returns | High, but more patient | Very high, typically within 5-7 years |

| Stage of Investment | Early-stage startups | Early to later-stage companies |

1.3 Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of people, typically via online platforms. It has become a popular way to finance new products, creative projects, and innovative startups.

- Example: Pebble Technology raised over $10 million on Kickstarter to fund its smartwatch, making it one of the most successful crowdfunding campaigns.

Advantages:

- Market Validation: Crowdfunding campaigns can validate the market demand for a product before significant resources are committed to its production.

- No Equity Dilution (in Reward-Based Crowdfunding): In reward-based crowdfunding, companies offer pre-sales or rewards rather than giving up equity.

Disadvantages:

- High Risk of Failure: Many crowdfunding campaigns do not reach their funding goals, and the process can be time-consuming and resource-intensive.

- Intellectual Property Risks: Publicly disclosing product ideas on crowdfunding platforms can expose them to competitors.

Types of Crowdfunding

| Type | Description | Example |

|---|---|---|

| Reward-Based | Backers receive a reward (e.g., product pre-order) instead of equity. | Pebble Technology’s smartwatch campaign on Kickstarter. |

| Equity-Based | Backers receive shares in the company. | Crowdcube and Seedrs platforms. |

| Donation-Based | Backers donate money without expecting anything in return. | GoFundMe campaigns for personal causes. |

2. Debt Financing

Debt financing involves borrowing money that must be repaid over time, with interest. This is a common option for established businesses with predictable revenue streams. The main forms of debt financing include bank loans, bonds, and trade credit.

2.1 Bank Loans

Bank loans are a traditional form of debt financing, where businesses borrow a lump sum from a bank and repay it with interest over a set period. These loans can be either secured (backed by collateral) or unsecured (not backed by collateral but with higher interest rates).

- Example: A company might take out a $500,000 bank loan to expand its operations, using its machinery as collateral.

- Key Terms:

- Collateral: Assets pledged by the borrower to secure the loan.

- Interest Rate: The cost of borrowing, usually expressed as an annual percentage rate (APR).

- Amortization: The process of gradually paying off a loan through regular payments.

Advantages:

- No Ownership Dilution: Borrowing does not involve giving up any equity, so the business owners retain full control.

- Predictable Payments: Fixed interest rates and repayment schedules make it easier to plan financially.

Disadvantages:

- Repayment Obligations: Loans must be repaid regardless of the business’s financial performance, which can create financial strain.

- Collateral Risk: Secured loans require collateral, which could be forfeited if the loan is not repaid.

Comparison of Bank Loans

| Loan Type | Interest Rate | Collateral Required | Repayment Period | Typical Use |

|---|---|---|---|---|

| Secured Loan | 4-8% | Yes | 5-30 years | Major capital expenditures, real estate. |

| Unsecured Loan | 7-15% | No | 1-10 years | Short-term working capital, operational costs. |

| Line of Credit | Variable | Possibly | Revolving | Managing cash flow, short-term needs. |

2.2 Bonds

Bonds are debt securities issued by companies to investors, who lend money in exchange for regular interest payments and the return of the principal at maturity. Bonds can be a useful way for large companies to raise capital without giving up ownership.

- Example: IBM might issue $1 billion in bonds to fund a new technology initiative, offering investors a 5% annual interest rate over 10 years.

Advantages:

- Lower Interest Rates: Bonds often have lower interest rates compared to bank loans, especially for companies with strong credit ratings.

- No Equity Dilution: Like bank loans, bonds do not require giving up equity in the company.

Disadvantages:

- Regular Interest Payments: Companies must make interest payments to bondholders, which can strain cash flow.

- Credit Rating Dependency: The ability to issue bonds at favorable terms depends on the company’s credit rating.

Bond Types

| Type | Interest Rate | Risk Level | Maturity Period | Typical Issuer |

|---|---|---|---|---|

| Corporate Bonds | 3-7% | Medium | 5-30 years | Large corporations like IBM, Apple. |

| Convertible Bonds | 2-5% | Medium to high | 5-10 years | Companies seeking to offer potential equity. |

| Municipal Bonds | 2-4% | Low | 10-30 years | Local governments, public projects. |

2.3 Trade Credit

Trade credit is a type of short-term financing provided by suppliers, allowing businesses to purchase goods and pay for them later. This form of financing is especially useful in industries with long production cycles.

- Example: A retailer might receive trade credit terms of Net 30, meaning they have 30 days to pay for goods received from a supplier.

Advantages:

- Improved Cash Flow: Allows businesses to preserve cash while still acquiring necessary goods.

- No Interest (if paid on time): Trade credit typically does not incur interest if the invoice is paid within the agreed terms.

Disadvantages:

- Short Repayment Terms: Payment is typically due within 30 to 90 days, which can be challenging for businesses with longer cash conversion cycles.

- Dependence on Supplier Relations: The availability and terms of trade credit are heavily dependent on the relationship with the supplier.

Trade Credit Terms

| Term | Description | Example |

|---|---|---|

| Net 30 | Payment due in 30 days. | Invoice dated July 1st must be paid by July 31st. |

| 2/10 Net 30 | 2% discount if paid within 10 days, otherwise Net 30. | Pay $980 if paid by July 11th, or $1,000 by July 31st. |

| Net 60 | Payment due in 60 days. | Invoice dated July 1st must be paid by August 31st. |

3. Grants

Grants are funds provided by governments, non-profit organizations, or corporations that do not require repayment. These are typically awarded based on specific criteria, such as industry focus, innovation, or social impact.

3.1 Government Grants

Government grants are available to businesses across various sectors, particularly those involved in research, innovation, or public services. These grants often come with strict usage and reporting requirements.

- Example: The U.S. Department of Energy offers grants for companies developing renewable energy technologies.

Advantages:

- No Repayment Required: Grants are essentially free money that does not need to be repaid.

- No Equity Dilution: Unlike equity financing, grants do not require giving up ownership in the company.

Disadvantages:

- Highly Competitive: Securing a government grant can be difficult due to the high level of competition.

- Usage Restrictions: Grants usually have strict guidelines on how the money can be spent.

Types of Government Grants

| Grant Type | Purpose | Eligibility | Example |

|---|---|---|---|

| R&D Grants | Support for research and development projects. | Companies engaged in scientific research and innovation. | SBIR (Small Business Innovation Research) program. |

| Innovation Grants | Funding for innovative projects with high social impact. | Startups and SMEs developing new technologies. | U.S. Department of Energy grants for clean energy. |

| Sector-Specific Grants | Grants targeting specific industries like healthcare or agriculture. | Companies operating within targeted industries. | USDA grants for agricultural research. |

4. Return on Investment (ROI)

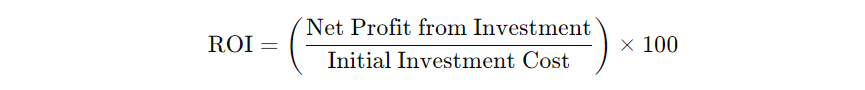

Return on Investment (ROI) is a crucial metric used to evaluate the efficiency of an investment. ROI is expressed as a percentage and is calculated by dividing the net profit from the investment by the initial cost of the investment.

4.1 Calculating ROI

ROI can be calculated using the following formula:

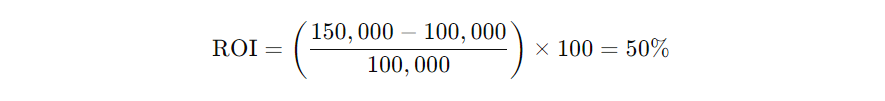

For example, if a company invests $100,000 in a project and earns a net profit of $150,000, the ROI would be:

ROI Calculation Examples

| Investment Type | Initial Investment | Net Profit | ROI |

|---|---|---|---|

| New Product Launch | $200,000 | $300,000 | 50% |

| Marketing Campaign | $50,000 | $80,000 | 60% |

| Equipment Purchase | $150,000 | $180,000 | 20% |

4.2 Using ROI to Attract Investors

High ROI figures can be persuasive in attracting investors, as they indicate that the investment is likely to generate significant returns. However, ROI should be presented alongside other metrics like payback period, Net Present Value (NPV), and Internal Rate of Return (IRR) for a comprehensive financial analysis.

Conclusion

Understanding the various funding options and their implications is essential for any business looking to secure financing. Whether through equity financing, debt financing, or grants, each option comes with its own set of advantages and challenges. Calculating and presenting ROI effectively is also crucial in attracting investors and securing loans. By carefully considering these factors, businesses can make informed decisions that align with their growth strategies and financial goals.

If you want to find more insights related to Online Business, please refer to the BIZNEYS forums. Reward valuable contributions by earning and sending Points to insightful members within the community. Points can be purchased and redeemed.

All support is sincerely appreciated.